A Data Paradigm to Operationalise Expanded Filtration: Realized Volatilities and Kernels from Non‑Synchronous NASDAQ Quotes and Trades

Abstract

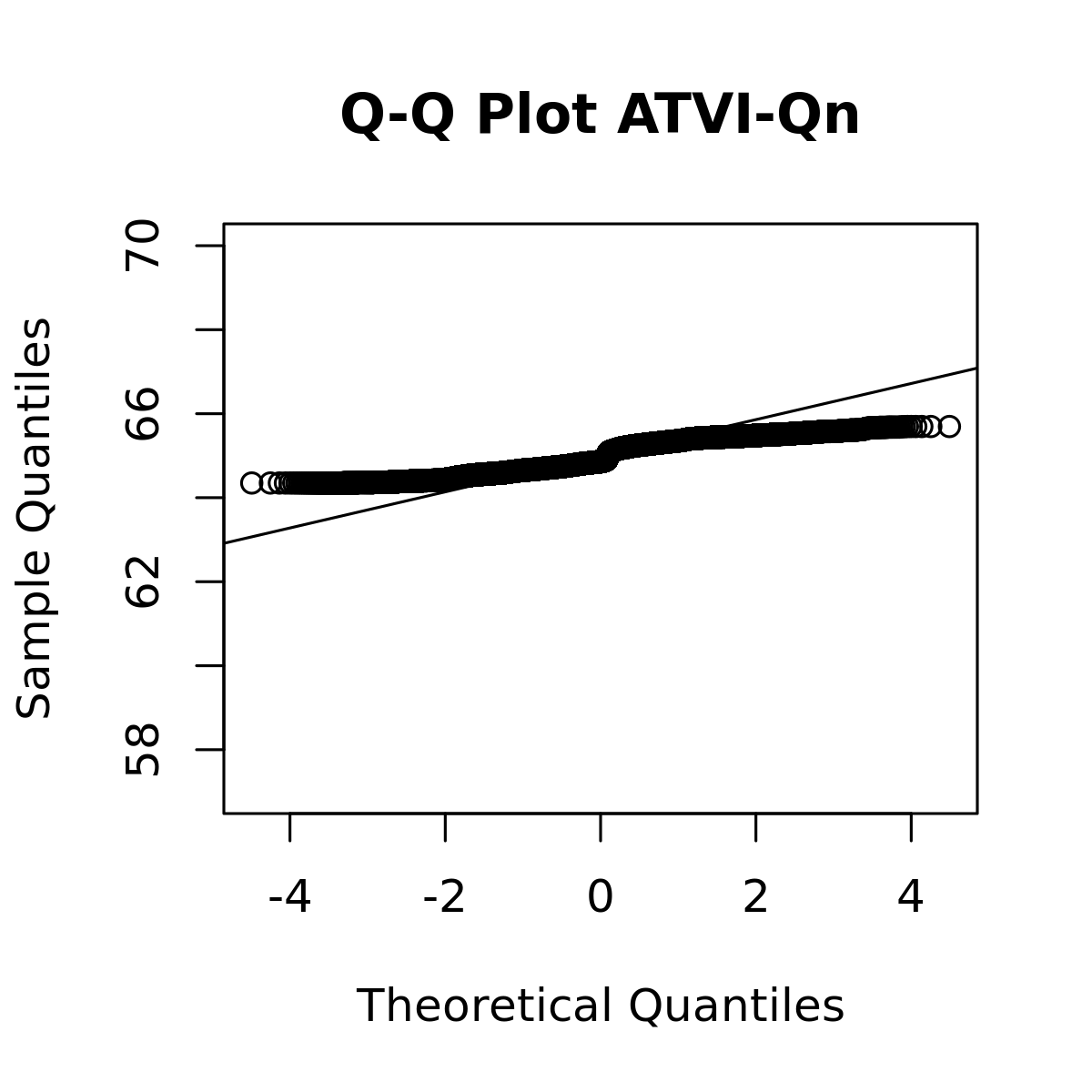

Ultra High Frequency (UHF) quotes and trades are examined in high resolution and data patterns that do not correspond to plausible market activity as in Brownlees and Gallo (2006) are identified. Noise patterns other than microstructure noise are isolated and diagnostic methods are evaluated accordingly. A flexible paradigm of data handling that synthesizes statistical technique and limit order book modelling is presented, extending Barndorff-Nielsen et. al. (2009), which operationalises the use of expanded filtration in empirical microstructure research. Empirical evidence from the NASDAQ 100 is presented, comprehensively demonstrating that removal of non-micro-structure noise from the limit order book adds significant robustness to estimation across techniques and levels of market depth.

Keywords

Robustification; Data handling; Limit order book; Model fit; Estimation; Filtration expansion; Ultra High Frequency

Article

Chakravarty, R.R., Pani, S. A Data Paradigm to Operationalise Expanded Filtration: Realized Volatilities and Kernels from Non-Synchronous NASDAQ Quotes and Trades. J. Quant. Econ. (2021). https://doi.org/10.1007/s40953-021-00252-0